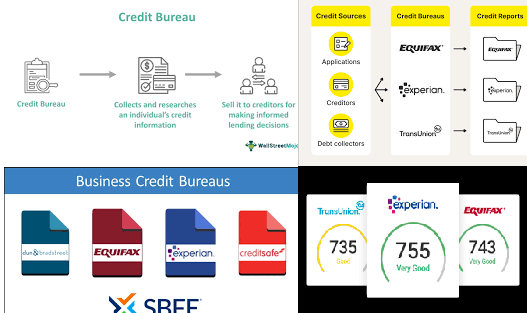

What are the 3 credit bureaus? Credit bureaus are companies that collect and maintain financial information on consumers, helping lenders assess the creditworthiness of individuals. In the U.S., there are three main credit bureaus that are critical to understanding credit health: Equifax, Experian, and TransUnion.

1. Equifax

Equifax, headquartered in Atlanta, Georgia, is one of the oldest credit bureaus, with roots tracing back to 1899. This bureau is known for providing detailed credit reports that help lenders make informed decisions on credit applications. They also offer various consumer services, including credit monitoring and identity theft protection.

2. Experian

Experian, headquartered in Dublin, Ireland, is another major credit bureau. It operates globally, providing credit information, fraud protection, and financial data services. Experian is particularly known for its innovation in data management and security, and it offers a wide range of tools for consumers to monitor their credit and protect against identity theft.

3. TransUnion

TransUnion, based in Chicago, Illinois, is the third primary credit bureau. This bureau provides comprehensive credit information and works closely with both individuals and businesses. They focus on maintaining up-to-date records and ensuring accuracy in consumer credit data, offering tools to monitor and protect financial health.

Which Credit Bureau is the Most Important?

While all three credit bureaus—Equifax, Experian, and TransUnion—play critical roles in evaluating creditworthiness, no single bureau is the “most important.” Lenders may choose to pull reports from one, two, or all three bureaus depending on their specific criteria and requirements. Therefore, it’s essential to monitor your credit score across all three bureaus to maintain a clear and comprehensive view of your credit health.

How Do I Contact All Three Credit Bureaus?

If you need to reach out to the bureaus for a credit report or dispute an error, here is the contact information for each:

- Equifax: www.equifax.com | Phone: 1-800-685-1111

- Experian: www.experian.com | Phone: 1-888-397-3742

- TransUnion: www.transunion.com | Phone: 1-800-916-8800

Are the 3 Credit Bureaus Free?

By law, the three main credit bureaus are required to provide consumers with one free credit report per year through AnnualCreditReport.com. Since the COVID-19 pandemic, the bureaus have offered free weekly credit reports, a policy which continues to help consumers monitor their credit frequently. Additionally, each bureau offers premium services, such as credit monitoring and identity theft protection, that may come at a cost.

What is the Largest Credit Bureau in the World?

Globally, Experian is often considered the largest credit bureau due to its international reach and extensive consumer database. While Equifax and TransUnion focus mainly on North American markets, Experian serves consumers in over 30 countries, making it the most extensive credit bureau worldwide.

What are the 3 Business Credit Bureaus?

In addition to consumer credit bureaus, there are also business credit bureaus that provide credit information on companies. The three major business credit bureaus are:

- Dun & Bradstreet – Known for issuing the D-U-N-S Number, essential for establishing business credit.

- Experian Business – Provides credit reports and data analytics on business entities.

- Equifax Business – Offers credit scores and financial data insights for businesses.

Who Pulls All 3 Credit Bureaus?

Certain types of lenders, such as mortgage companies and auto lenders, often pull credit reports from all three bureaus to obtain a comprehensive view of a consumer’s credit history. When lenders pull reports from all three bureaus, they can verify information accuracy across the different agencies, helping them make well-informed lending decisions.

Which is the Oldest of the 3 Credit Bureaus?

Equifax holds the title as the oldest of the three main credit bureaus, established in 1899. This long-standing history contributes to its extensive database and a broad range of services that have evolved to meet changing financial and technological demands.

What are the Top 4 Secondary Credit Bureaus?

Apart from the three main credit bureaus (Equifax, Experian, and TransUnion), there are several secondary credit bureaus that specialize in various forms of credit information:

- Innovis – Focuses on alternative data sources and is sometimes used by creditors for supplementary information.

- PRBC (Payment Reporting Builds Credit) – Offers data on rental, utility, and other payments for consumers with limited credit history.

- ChexSystems – Tracks consumer activity related to bank accounts, mainly used by banks and credit unions.

- SageStream – Provides additional data analytics, often used for identity verification and fraud prevention.

Which of the Following is One of the Four Major Credit Bureaus?

The term “four major credit bureaus” typically refers to Equifax, Experian, TransUnion, and Innovis, with Innovis often serving as a secondary source of information. Innovis provides additional credit data and is used by some lenders as a supplemental source, though it is not as widely referenced as the main three.

In summary, knowing what are the 3 credit bureaus is essential for understanding credit health. Each bureau serves a unique function, and monitoring your credit report with all three can help you maintain a comprehensive picture of your financial standing and creditworthiness.

Read more:

1= https://rapidurlindexer.net/blogs/what-are-the-3-main-credit-bureaus/

2= https://rapidurlindexer.net/blogs/what-are-the-3-most-important-branches-of-government-called/

3= https://rapidurlindexer.net/blogs/what-are-the-worst-side-effects-of-prednisone/